Unless you’ve been living under a rock, you’ll be aware of the massive slump in stocks worldwide currently. This has been the results of the worldwide CoronaVirus epidemic we are currently experiencing. However, while many are selling their investments to reclaim as much value as possible, I am actually increasing my investments.

My Investment Tactics for Coronavirus Market Success

My main tactic for investment in the stock market isn’t particularly complex. I don’t perform in-depth analysis of individual stocks. I simply don’t have the time, and my career doesn’t permit me trading in individual stocks. So, you won’t see me dabbling in puts/calls any time soon like many are at the current moment.

I simply started my most recent investment fund with a lump sum of £5,000 and then top it up every month via direct debit. The amount I put in depends on the performance of the market, but not in the way you might think it does…

The higher the market goes, the less I put in, and the lower it goes, the more I put in on a monthly basis. I obviously have slight deviations to this when I have surplus cash to play with, but this is the general rule for my investments.

Based on this method, Coronavirus’ (Covid19) impact upon my investment is simply meaning I am taking advantage of the lowering price of my S&P500 Tracker Fund. As once the stock market rebounds (and it eventually will), I will have bought a large chunk of my ownership at a reduced rate, and therefore increasing my potential future gains!

Admittedly, I am in a very fortunate position where I can take advantage of this at the current time. However, I would always recommend people to put as much money away as possible each month into an investment fund. Even £100 a month can amount to a very nice retirement fund over 40 years. But you have to make sure you start early! Luckily I think the current generation of younger people are more aware of this, so we should see many people taking advantage of this slump in the markets.

How Long Will The Stock Market Decline Last?

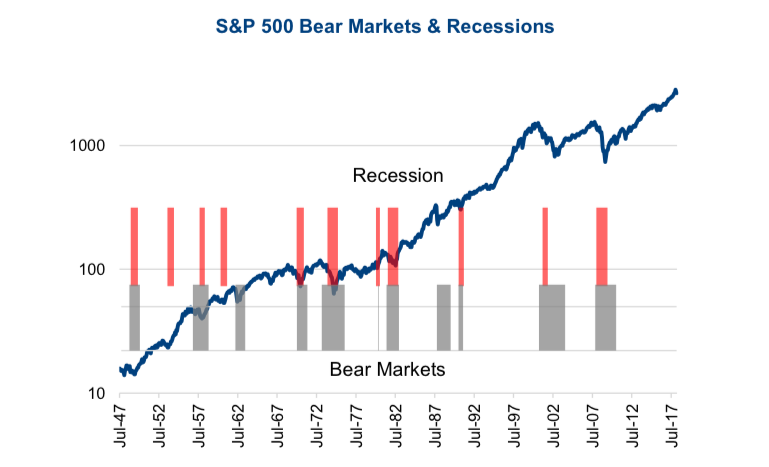

Nobody knows, and anybody who says they do is lying. I just know that I can say with relative confidence that I know in the distant future, the stock market will be higher than it is today. Even if on the day I retire, we have a recession, it will likely be higher than even the highs of 2019. That is historically how the stock market has worked:

As you can see from the above, over long periods of time (15+ years), you’re pretty much always going to make gains. Admittedly, market timing is an impact on how good your gains are, but that’s another matter.

This is a new style of post by me – If you would like to see more like this, please leave a comment below!

Aw, this was a really nice post. Spending some time and actual effort to make a superb article… but what can I say… I hesitate a lot and don’t manage to get nearly anything done.|