With the recent news that Dan Bilzerian’s company, Ignite, may be going bankrupt soon, and is being investigated by the SEC, I thought I would take it upon myself to review Ignite’s financial statements, and give my opinion on what may be going on there below the surface.

To give a quick background on me for anyone who is new to the blog: I am a fully qualified Chartered Accountant, and gained my qualification while working in Audit for a Big 4 firm. I have a wide breadth of experience across financial services companies, large and small.

The interim accounts for Ignite were recently released. This means that they cover the first six months of the year. Keep that in mind, as they cannot be directly compared to the 2019 accounts, and simply annualising the accounts won’t necessarily provide an accurate estimation, especially during this erratic year.

For comparisons, I will be analysing the interim 2019 accounts to the latest 2020 interim accounts for accuracy.

Please note: Anything stated within this post is merely my opinion as a qualified accountant, and you can take your own judgement and research the accounts yourself. Anything I am using as a reference point is entirely publicly available and I will link where relevant throughout this post. Nothing stated in this article is proven fact, and just assumptions made in my professional opinion based upon the material provided to me. There is no intention to slander or bring into disrepute Dan Bilzerian or Ignite.

Ignite Profit & Loss

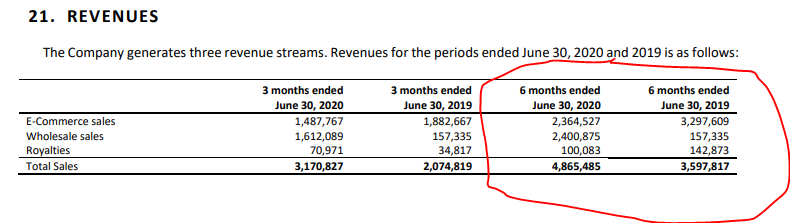

Looking at the top line of the P&L, we can see that things are looking good for Ignite on a Revenue basis. They’re up about $1.2m compared to the same time period in 2019. However, there has been a significant increase in expenditure, and therefore the gross profit has only seen an increase of 150k. Therefore, the margin made on sales revenue is significantly smaller in 2020.

On the face of things, it looks quite good for Ignite. Despite expenditure increases, their overall profit is still up here. But lets look a little deeper…

We can see here that of the revenue made in 2020, there has been a sharp decline in e-commerce sales in the period. This is surprising, considering we’ve seen a significant increase in online shopping due to lockdowns globally. However, this could also be due to limited stock production from China. Therefore a reduction in sales. But, diving a little deeper into this, we can see a massive increase in wholesale sales. Therefore, there’s no shortage of product, it just seems to be going in a different direction, instead of straight to consumer.

The downside to this for Ignite is that wholesale prices are generally at a significant discount to commercial sales. This is because wholesalers/businesses will be buying in large bulk. For example, selling Product A to the consumer for $50 is likely to be more like $25 per unit at a wholesale price. This is likely what is causing the slump in the gross profit percentage:

In the 6 month period of 2019, Ignite saw a gross profit percentage of roughly 38% (1.3m/3.6m), but this has decreased to 30% in the same period of 2020 (1.5m/4.85m). This is likely due to a significant increase in sales to wholesalers, but a far smaller profit margin being made per unit. So, production costs will likely stay at a relative constant price per unit (with some slight wiggle room from economies of scale), but the profit made per unit has dropped. Therefore, we can see an increase in costs, but not as significant of an increase in the revenue.

This is essentially why their profits haven’t increased that much despite the large increase in revenue.

Operational Expenses

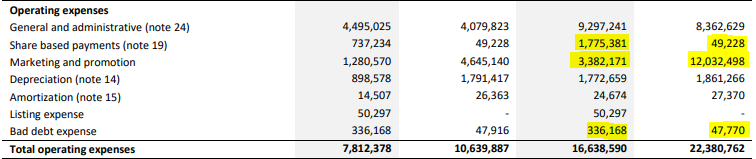

Let’s wind our way down the P&L statement a little further and focus on the items I have highlighted in yellow.

Share Based Payments

Per IFRS 2, a share based payment is a transaction in which the entity receives goods or services as a consideration for its equity.

Primarily, the difference here seems to stem from a significant amount of stock options. The 1.78m in share based payments are kept relatively tight lipped within the financials in terms of exactly what they were related to. There is a lot of information in note 19, without really telling us much. From an accounting perspective, this tends to happen when things wish to remain hidden, so they try to overcomplicate a note.

It does not state who the share based payments are benefitting. However, it is more than likely the directors of Ignite who are gaining some benefit here.

Marketing and Promotion

It seems we have had a significant reduction in the costs here. However, there are rumours which state that directors are running their personal lavish expenses through the business as a marketing expense, which is one of the reasons Ignite has received so much negative attention as of late. There is argument that the marketing fee has been utilised for Dan’s rental of his lavish home, as well as other directors using the amount to go out on a yacht.

Bad Debt Expense

A Bad Debt is essentially a debt which has been recognised as income which will not be collected. For example, Ignite could have issued a credit invoice to a business for $336k, and then realised that the company has gone bust, and therefore they will not receive that amount. This is one of the downsides of allowing customers to use credit, as there is always a risk of default.

There has been a reasonably significant increase of the bad debts this year. However, to some extent this isn’t a surprise, with many businesses struggling financially due to Covid.

Ignite’s Overall Net Profit 2020

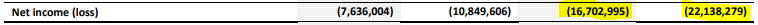

So, remember that small gross profit that Ignite had made in the first half of 2020? Well, that didn’t last long with the significant amount of Operational Expenses they have accrued, as well as some pretty significant finance expenses.

A total loss of 16.7m so far in 2020. A positive could be taken in that they’ve managed to reduce their loss by just over $5m since the comparable period last year. However, such a significant loss is definitely nothing to boast about.

There is quite a trend for start-ups (especially recently) to be significantly loss making initially. But, Ignite has some really significant costs which is really dragging them down here. In order to stand a chance in the long term, they either need to cut their costs significantly, or majorly increase their revenue. The key being a focus on an increase in their profit margin on products as well, as currently that is particularly small.

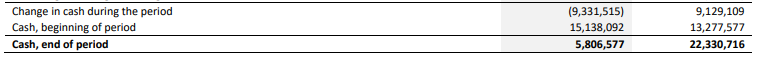

Ignite Cash Levels

Ignite have burnt through just under $10m in cash in the first half of 2020, with a remaining cash balance of 5.8m. Assuming they keep that level of spending up, without any further cash injection, they could find themselves to be starved of cash by the end of October, or start of November.

What does this mean in simple terms? Well, if Ignite doesn’t come up with a significant injection of cash, they will be unable to pay staff, rent, product costs etc. This means that the company could end up in significant debt, and could eventually be forced into liquidation.

On top of their problems here, they’ve seen a significant rise in stock. This could mean one of two things. Either they’re expecting a huge demand for their stock in the near future, and they’re preparing for it. Or, what I suspect to be the case, they’re struggling to match sales to the demand they expected, and therefore they’re seeing rising stock levels. Considering their stock levels are currently 8.1m, and their sales equate to 4.8m per half year, it is unlikely they’re going to sell off that stock any time soon. This means a significant amount of money is being tied up in stock. Their 16m half-yearly loss would have been immensely lower if they had managed their stock levels better. For example, if they only held 1-2m worth of stock, instead of 8m, they would have made a loss of $10m instead. It is changes like this which could lead to Ignite earning a profit eventually.

Loans

Another severe problem is the sheer level of loans that Ignite possess. Currently sitting at just shy of $26m in convertible debt, $1.5m in long term loans and half a million in lease obligations. Note: Convertible Debt is a way in which people can received a yield, or convert their debt into a predetermined number of shares. For example, a group of investors could have agreed to give Ignite $26m, in which they will be paid a rate of 5% interest on their ‘loan’ per year. Then, after 5 years, could convert that into a specific number of shares, which could eventually be worth significantly more than the $26m they initially paid.

It is worth noting that the convertible loans are not much use if Ignite continues to perform badly, as the shares will not be worth much. If Ignite does go bust, it is likely that the convertible loan stock will net the investors nothing.

The $1.5m in loans that Ignite have are primarily down to the $1m in salary protection loans they received from the Government due to COVID-19.

It doesn’t state in the accounts what the $500k of lease obligations relates to. This could be anything from company cars, to machinery for their products.

Concluding on Review of Ignite Financial Accounts

Is Ignite a company you would invest in based on what you’ve seen so far? It seems as though the 2nd half of 2020 could be very interesting for Dan Bilzerian and Ignite. It could be that the accounts seem worse than they are, however, this is very rarely the case. I will be interested to see if they survive the remainder of the year, and can be considered a going concern going into 2021.

It seems as though the losses will continue into 2021 at the rate of which they’re going. The marketing costs need to be significantly reduced, and a focus needs to be put on the significant financial costs related to the loans.

The rate of cash in which they’re burning through will make the final few months of 2020 difficult for Ignite, and some tough decisions will need to be made.

I’d be interested to know your thoughts in the comments section below, You can check out the financials for yourself here. Just search for ignite!