What is ICAS?

ICAS stands for the Institute of Chartered Accountants of Scotland, and was the first official professional body for Chartered Accountants. This allows them to be the only body to denote “CA” after your name (which I proudly possess).

The body was originally formed in 1854, from three individual institutions in Scotland, and renamed as the Institute of Chartered Accountants of Scotland in 1951. There is far more detail on ICAS’ history that I could delve into, but I don’t want to bore you before we’ve even started this long post. However, there are plenty of nuggets of information online which go into detail on how ICAS has come to be what it is today.

Despite the name, you don’t have to be in Scotland in order to train with ICAS (I wasn’t). The main reason I had heard of ICAS however, is because I studied for my Accounting degree in Scotland, where it is held in high regard as the #1 Accounting Qualification quite rightly.

In summary, ICAS is a professinal institution, allowing you to train and learn how to become the very best qualified accountant you can be. There have been huge contributions from ICAS CA’s throughout history. One notable mention is Sir David Tweedie CA, who founded the International Accounting Standards Board, which is one of the governing regulators of Accounting Standards.

Why I Chose ICAS

I previously mentioned that I had studied for my University Degree in Scotland. This is partially the reason that I studied with ICAS. Inherently, ICAS is far more popular in Scotland than in England or further afield.

I had applied for a job through a website at the time called “BecomeACA” which was run by ICAS and basically listed job openings for aspiring CAs.

This landed me a job much further afield in a small financial hub – but still I studied ICAS.

The way my firm arranged studying was the University Graduates did ICAS, and the School Joiners did ACCA. It is worth noting at this point that you need a University Degree in order to do ICAS, which is a unique requirement for the accounting bodies. ACCA on the other hand is open to anyone. You DO NOT need an Accounting Degree however, just a degree from a University.

So, I guess in a way, you could say I didn’t technically choose ICAS…ICAS chose me – I was just desperately applying for jobs in my final year of University, and the perfect job landed at my feet. Realistically at the time I would have taken absolutely any job I could get which would have made me a qualified Chartered Accountant. However, I really lucked out by landing a Big 4 job.

While I was at University, it was really pushed on us that ICAS was the best qualification to go for, unless you wanted to go down a more specialised field (for example, CIMA – which specialises in Management Accounting). Admittedly, the Scottish University is going to be a bit biased. Throughout this post I will try and remain as unbiased as possible in my viewpoints.

My ICAS Experience

My ICAS story lasted a total of three years from start to complete qualification.

I joined EY in the first week of October of 2016. I spent the first week doing general admin involved with joining a new firm. However, week two was straight in the deep end of ICAS.

My first day of ICAS

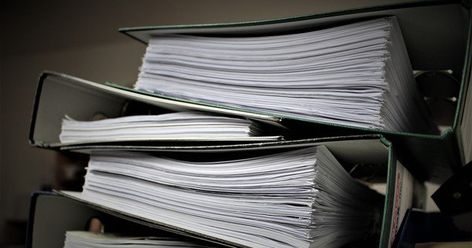

We all walk into the room we were being taught in. It was a classroom style set up, and about 20 of us were in the class (all working at EY). On each of our desks is about five HUGE folders, filled to the brim with paper.

This was obviously incredibly daunting, and nothing I had experienced to date from my time at University.

There was no waiting about, once the nicities of the lecturer introducing themselves were completed, we dived into the first folder and started learning. The plan was we had to get through all five folders in approximately 7/8 weeks, and then sit an exam on each in the first week of December spread over three days. We would have one exam Monday morning, one in the afternoon and so on.

In retrospect at this point, it is difficult to truly feel how difficult ICAS was at the time. However, I remember feeling as though I had never experienced taking on that much information and knowledge in one go and in such a short space of time. I felt like I was drowning the majority of the time.

The ICAS Setup

ICAS is laid out in three levels. Also, please bare in mind the syllabus has changed slightly since I first qualified. I believe they were bringing in more of a focus on ‘online’ aspects as I qualified. You have:

– TC (Test of Competence – Level 1)

– TPS (Test of Professional Skills – Level 2)

– TPE (Test of Professional Excellence – Level 3)

Each level encapsulates everything you have learnt up to that date, but in far more detail.

Studying for ICAS

My main method of studying was just constant question practice. ICAS emphasise this themselves again and again. However, despite this, students still don’t listen. Many people in my class would re-write notes, and read their notes, and ignore questions until they felt as though they had an understanding. These were often the people who would fail the exams.

I would go to class at about 8am, and class would finish around 3.30pm. I would then go and grab my dinner from the shops on my way back to the EY office, and study there until about 9pm (sometimes earlier, sometimes later.

On a Saturday & Sunday I would do the same timetable, but just study in the office from about 9am until 8pm

There’s no doubt that studying for ICAS is intense due to the amount of information in one swoop. ICAS won’t admit it themselves, but anyone with a reasonable amount of intelligence can become a CA – It isn’t technically hugely difficult. However, it is a massive intense mind game. Long hours, constant progress test failures, feeling as though you’re not progressing. It is a huge test of your mental strength. Those who are consistent and can bash through it will generally succeed. This is where I think one of the key differentiators between ICAS and other Accounting Bodies lies.

Advice for Succeeding Studying ICAS

Firstly, before you even go down to route of studying for ICAS, or joining a Big 4 – Make sure it is exactly what you want to do. Not necessarily working for a Big 4, but having a career in Accountancy/Finance.

It can be a bit of a rabbit hole that you get stuck in. I know of many people who don’t actually like what they do, but they have to stick with it because they’ve made it so far. Once you’re a qualified Accountant, it is difficult to make a significant career jump without starting from the beginning again. Once you’re in Finance, you’re generally in there for life, unless you’re incredibly lucky, or willing to just make huge risks/pay cuts.

My main reason for wanting to be an accountant though is that if you’re not that bothered, you will struggle with the required motivation to study for ICAS. You need to want to put in the 12 hour days of studying. That isn’t for everyone. Make sure you’re willing to put that work in for approximately 4 months of your life over three years.

Secondly, listen to what your lecturers tell you. I know this may sound stupid and obvious, but you’d be amazed the amount of students who think they know better on how to study for the exams. Your lecturer will have notes and information on ICAS which you do not have. This generally provides a little bit of insight into what that year’s exams may be like, or what they may entail. Obviously your lecturer wants you all to pass. It looks bad on them if you don’t.

They will often tell you to focus on question practice. Do this! It is the single best piece of advice I could give you. I want you to literally get to the point of practice where you can almost memorise the answers to questions without even reading the whole question.

It is going to be frustrating and tedious at times, but it is what needs to be done in order to succeed. Especially at TC level.

There is only so many variations of questions that ICAS can make up. Eventually you’re going to notice a pattern. They’re just the same questions with different names, different numbers and a slight twist. But overall, once you can master one question on depreciation, you can do them all, for example.