I have now been using DEGIRO for about a year, and I feel I am in a good position to do an overall review of my experience, including all the good and the bad points.

I was initially attracted to DEGIRO due to the ease of signing up, as well as the low fees. I didn’t plan to do any day-trading or anything complex, just a long-only investment strategy for my retirement. I didn’t need any complex options.

I will go on a breakdown of all aspects of DEGIRO including the types of accounts, what you can invest, and how their low cost format works from my experience.

I guess the question is, should you use DEGIRO in 2020?

This is my 2020 review of DEGIRO.

Note: Investing has the potential to have lost capital – Make sure you are aware of this. I take no responsibility for any amounts gained/lost when you invest.

Who is DEGIRO

Before we dive into the review of DEGIRO, I want to give you a summary of who they are, and their purpose.

DEGIRO was founded in 2008 in the Netherlands. So, they’re a relatively new company in the grand scheme of things, but starting to get to the stage of being established.

DEGIRO was opened to the public for retail clients in 2013 and in 2015 this service was expanded to all other European countries.

They are regulated by the Netherlands Authority for Financial Markets and also registered with the Financial Conduct Authority (FCA)

The primary selling points of DEGIRO are:

- Low cost investing

- Free ETFs

- Regulated

- In-house development

- Access to a large number of exchanges

DEGIRO over time have managed to solidify themselves as one of the most popular brokers in Europe, which is why they came onto my radar initially.

As of 2020, DEGIRO are in excellent financial health, and continuing to build their client-base year on year.

What Can You Invest In With DEGIRO

There are so many trading options with DEGIRO, which was one of the key factors which initially attracted me to them.

When you’re trying to decide on a broker, you need to make sure that they offer a broad range of investment capabilities which you will utilise.

The main selling point in DEGIRO’s favour here is their wide selection of ETFs (and even some FREE ETFs). If you’re a simple ETF investor then I believe that DEGIRO may be the stock platform for you. However, if you’re looking for some complex instruments, then DEGIRO may not cover all of your requirements in the best manner.

The selection of Bonds is a little limited in comparison to their ETF offering – However there are still possibilities to invest in Bonds from 6 of Europe’s top exchanges.

For your stock & ETF investing, you have access to all the key worldwide stock exchanges. Unless you’re trying to access some very obscure markets, then you will definitely be covered in this regard.

My primary investments are in S&P500 Tracker ETFs, of which there are a tonne to choose from! There are even some free options here, which I will get onto later.

There is access to some more complex instruments such as Futures (14 different exchanges) and Options (12 different exchanges).

DEGIRO offers such a wide array of investment capabilities, and they break all the different products & markets they offer on their website for a more in-depth breakdown.

DEGIRO Account Types

DEGIRO Account Types: Basic, Custody, Active, Trader, and Day Trader.

I personally just have a basic account. The main factor that changes with the other account types is the addition of utilising leverage. I have no need for this.

I would never recommend using leverage unless you really know what you’re doing.

The basic account is definitely the type which most people will use, and is probably the most versatile of the options. This will give you access to the vast majority of DEGIRO. There are no fees or limitations involved in a basic account other than the lack of leverage.

The other options have access to leverage at different levels. So if leverage is something you’re looking to utilise with DEGIRO, then look at the inidividual Account Types and decide which would fit your requirements the best.

The reason that DEGIRO can offer such low fees, and even free investment in some ETFs is due to the collaterol setup utilised. If you hold stocks on DEGIRO, they have the ability to lend your shares to others who may be shorting stocks (ie – selling stocks they do not currently own).

However, it should be noted that DEGIRO will guarantee your stock lending with a collaterol of 104% and there are also requirements for the short seller to meet certain margin requirements. The actual risk here is almost non-existent. You just reap the benefits of the hugely cheap service that DEGIRO provides.

If however you feel uncomfortable with this, there is a Custody account in which DEGIRO cannot use your balances for stock lending. This is more expensive than the other options though, and if the stock lending is putting you off, I would consider some other brokers which don’t utilise stock lending.

In my opinion, there is very little risk with securities lending with DEGIRO. The aforementioned collaterol adds protection, and on top of that your stocks are held within an SPV and not DEGIRO directly. So, if DEGIRO were to go bankrupt or abruptly close their doors, you can still reclaim your shares from the SPV. In addition, you have the right of return on any shares which have been borrowed from your account.

You won’t even notice the stock borrowing happening with your account. The account balance will stay the same, there are no movements.

NOTE: Make sure you think about which account is right for you before you sign up to DEGIRO as it is not free to change your account type.

If you would like more detail on DEGIRO Account Types, you can access a profile summary page on their website.

DEGIRO Fees

I mentioned before that one of the key determinants of me using DEGIRO was the low cost aspect – So let’s talk about the fees involved with using the platform.

DEGIRO fees do differ depending on your location, so it would be best to double check any figures on your local site. I will be breaking down the fees from the UK website.

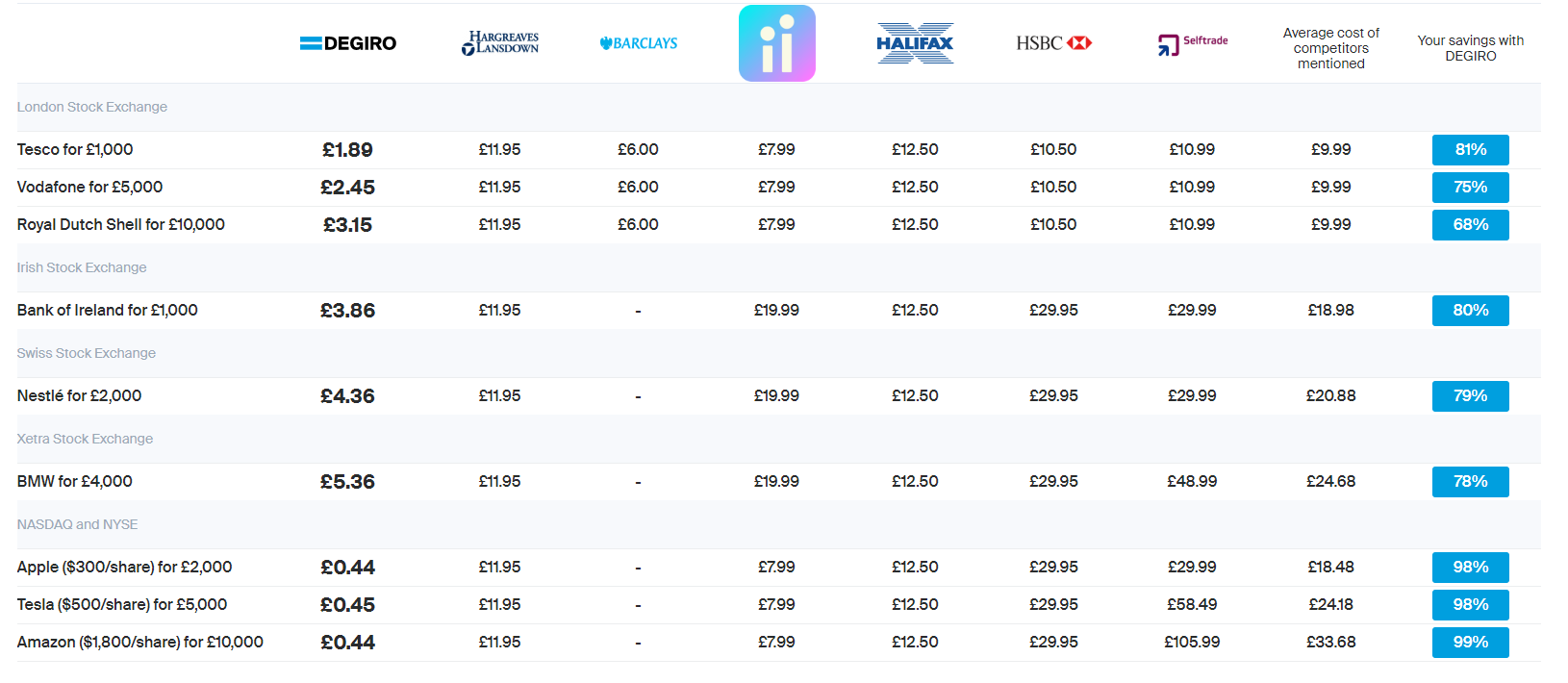

A great breakdown comparison to other brokers is provided as an example on the DEGIRO website:

Click here for a direct link to see in more detail

Click here for a direct link to see in more detail

As you can see, the fees they charge means that they’re significantly cheaper than a lot of more mainstream brokers. These are the costs for actual stocks though – while many people will be investing in ETFs if using DEGIRO (like me!)

The main key selling point for DEGIRO in my opinion is the fact you can trade a select group of ETFs for FREE! Each month I can invest a lump sum into an ETF without any transaction costs whatsoever. In addition to this, if I make a further investment in the same month in the same ETF, that is also free. This means if you’re like me and have a very passive monthly investment strategy, DEGIRO is perfect for you.

Here is a list of DEGIRO’s FREE ETFs.

The only cost here is when you decide to invest in an ETF which isn’t in your base currency. For example, the S&P500 Tracker I utilise is in EURO, while my currency is GBP. Regardless, the fees involved are very small and I often do not even notice. Some may argue it shouldn’t have an exchange fee at all, but unless you’re investing large sums of money in one go, you’re really not going to care at all, and it is minor in the grand scheme of your overall investment.

The only other fee involved with investing on a DEGIRO account is the connectivity fee on an annual basis. However this is a measy 2.5 EUR per year, per stock exchange (not including your local home stock exchange).

The main point I’m making here is that DEGIRO is going to be the lowest fee broker you will find in Europe.

It should be worth noting that you should check the fees for your specific country, as they can differ on location.

DEGIRO Security/Safety

This is a concern with most people. You don’t want to hold your money anywhere where it is at risk of theft or loss outside your control.

As of 2020, there have been no security breaches within DEGIRO’s systems. Considering the trend of online attacks and leaks of private information as of late, this is a good sign.

DEGIRO offers Two Factor Authentication for your account as well which is always a nice safety blanket to have over your account.

In terms of security of your assets from DEGIRO themselves – your investments are held within a separate SPV and therefore protected from DEGIRO bankrupcy. This means none of your shares are held directly in DEGIRO’s possession, and can be reclaimed in the unlikely event that they go bankrupt.

Your sitting cash balances are also not held directly with DEGIRO but invested into money market accounts, which are also held at arms length from DEGIRO themselves. I don’t often keep large amounts of cash sitting in my investment account, but it is good to know that sometimes when I delay investing the cash for a few days, that it is safe.

Based on the above, I am pretty confident that DEGIRO is both secure and possesses safety of your assets. They have plenty of IT Security measures in place which gives me personal comfort, as well as the separation of my assets from their books.

DEGIRO Reputation

Reputation is always something I take with a pinch of salt – this can often be massaged to look better than it is. Trust me, I worked in online marketing for over 5 years, I know how to make a company look better than it is online. However, I also know how to look through the BS when it comes to a company online and see any “fake” marketing twists to create a mirage of positivity.

I did a deep dive on DEGIRO’s reputation online to see what I could find, and make my own conclusions on if they’re really as good as they seem.

It is worth noting that DEGIRO has won many awards over the years – 65 to be precise. I think sometimes these awards should be taken lightly as they can often be awarded to the companies who pay the most for seating attendance at the awards. However, we cannot assume that this has been the case with DEGIRO.

Throughout the internet, there is mostly praise from the media, and they’re regarded by many in a positive light. The main headline for stories on DEGIRO is simply about their low costs.

The general reviews on websites like TrustPilot are good, but not great with a current score of 3.1/5 – This seems to have been majorly impacted recently by a glitch in their system which delayed payouts of withdrawals, which understandably led to some complaints. However, this is the downfall of online review systems. Temporary glitches can cause huge negative swings in the overall rating. Other than this, most negative reviews seemed to stem from inexperienced investors making mistakes worth very little money and demanding their money is returned. This is why I would say if you don’t know what you’re doing in the stock market, you shouldn’t be doing it, and most of all, you shouldn’t invest anything you’re not willing to lose.

I personally can attest to slow bank transfers IN to DEGIRO. This often takes two business days for me, which has been unfortunate recently if you wanted to get money into your account quickly to take advantage of market downswings.

I’ve never had any issues with their customer service before. I had a query once regarding the booking of my trade requests, and they resolved it very quickly and with a positive result on my trading.

When it comes to online reviews, you need to take them with a pinch of salt. Negative viewpoints are always statistically more likely to crop up, and in addition to this, many of the people posting negatively haven’t done their due dilligence to know what to expect. You can’t complain about unexpected fees when you haven’t read the fees and small print fully. Always do your research!

As I mentioned, bank transfers are slow, but I do an automatic direct debit at the end of the month when my salary is paid and by the time the 1st of the month rolls around, my account balance is ready.

My Experience Investing with DEGIRO

Now, I’m going to go into a bit more detail on my personal experience with DEGIRO.

To summarise in one line, I’m pretty happy with my experience so far with DEGIRO. For what I use them for, it is simple and easy to use. I feel as though DEGIRO is the best broker in Europe for simple investors. If you’re not shorting/leveraging/options etc then DEGIRO is great. In fact, if you’re an ETF investor I feel as though they’re probably the best hands down.

The time it takes to transfer my cash from my bank account to my DEGIRO account is a bit of a gripe I have, however it isn’t the end of the world. I’ve just planned ahead and made sure my money is ready by the start of a new month in order to take advantage of the free ETF purchase.

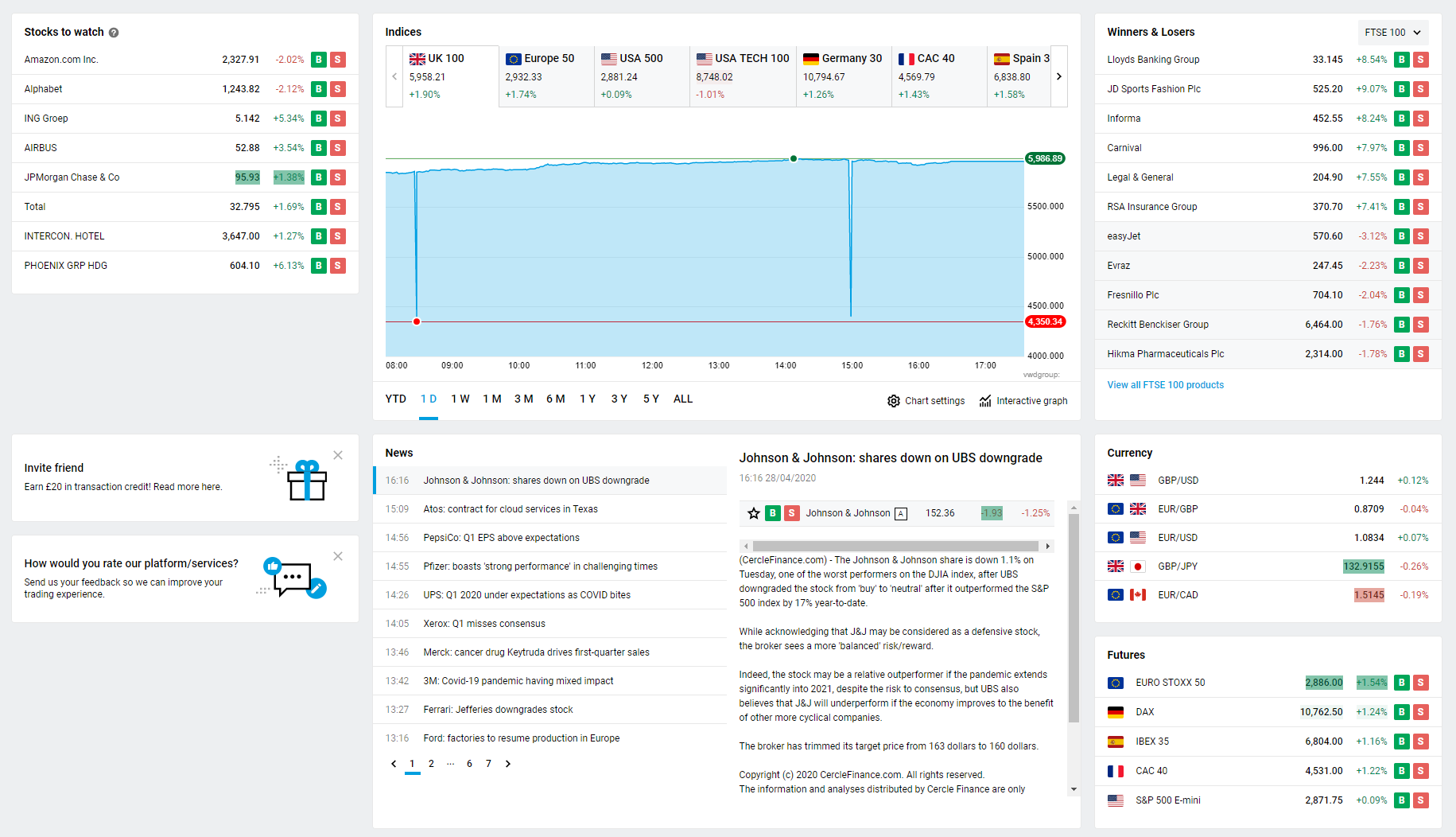

I generally like both their web & mobile application layouts. I haven’t executed any trades within the app, as to me it seems more prudent to stick to the full layout when making trades worth thousands. However, I regularly use the app to check if my cash balance has cleared, as well as the ups/downs throughout a day.

Web Application

I’ve had no complaints about how the web application works. It is very straightforward – and most things are easy to access or work out. The only time I couldn’t figure something out, their customer service was more than helpful on the phone.

Mobile Application

The only downside I see to the mobile app is that you log in using a 5-digit password, which seems a little lacking in security in my view. However, it is convenient, and even my bank account app has this feature these days. Perhaps it is more secure than I assume. I’m not an IT Security expert at the end of the day.

Account Creation

Creating an account with Degiro was pretty simple for me.

It is like opening up any other type of account online, and their website guides you through the process in a simple manner. There’s obviously some extra steps in place by them to make sure they can cater to you, and you’re a genuine investor etc including providing evidence of ID.

You also need to transfer some money into the account in order to active your account fully. At my time of sign-up I just put £50 into the account in order to get everything fully functioning and explore DEGIRO before I deposited any larger amounts.

DEGIRO’s FREE ETF Options

I’ve mentioned these a few times throughout this review, but I felt this needed a quick section by itself, as it is such a winning factor for DEGIRO.

These FREE ETFs are all I invest in currently. They’re simple to invest in, and there’s no transaction fee involved. It couldn’t be any simpler to dip your toe in the world of investing.

Go and take a look at a list of their free ETFs and see if any take your fancy.

My current investing strategy is to just stick with investing in my S&P500 Tracker ETF monthly for the forseeable future, especially during these uncertain times during the Coronavirus outbreak.

DEGIRO Pros

I think I’ve covered most of the pros of using DEGIRO throughout this post, but let’s summarise:

- Low Fees. DEGIRO is without a doubt the cheapest European broker. This is their key selling point, and what the business is marketed on. You can save a lot of money using DEGIRO, especially if using an ETF strategy

- Free ETF trades. I’ve mentioned this more times than I care to admit throughout this review, as it is my winning point for DEGIRO, and the main reason I use them. This has allowed me to invest thousands into my portfolio without losing any money to transaction fees.

- Simplicity. There’s nothing fancy about DEGIRO. It does what it says on the tin. They’re a low cost, simple to use broker. Nothing more, nothing less. If you want complex instruments & options, then look elsewhere

- Interface. Both the web application & mobile application are easy to use. I’ve experienced some systems in the past which were very clunky and difficult to navigate around.

DEGIRO are growing into a huge platform, and this only strengthens their case to invest using them. In 2019 they were involved in over 50 BILLION in transactions.

DEGIRO Cons

There are some negatives of DEGIRO that I mentioned. Let’s summarise:

- Slow bank transfers. This is my #1 gripe with DEGIRO. If I could make transfers in less than 24 hours, it would be great. They should really look to improving this in the future. You can top up most accounts within minutes, I don’t see why DEGIRO can’t implement this.

- Share lending. This could be viewed as a bigger negative by some more than others. I think the low fee nature of DEGIRO is a double edged sword. They need to profit somewhere, and if you’re not paying large fees, they need to participate in the share lending to increase their revenue.

- Communication. I personally haven’t experienced bad communication with DEGIRO, however it was definitely a trending issue that others seem to have had online. If constant perfect communication is a key attribute for you, then this may be an important one to note.

- Account changes. You cannot change your type of account easily. This seems a little stupid, and could be resolved easily. I’m not sure if there’s some sort of regulatory reason for it, or whether DEGIRO just hasn’t got the infrastructure to easily/simply move account types around. Perhaps different account types are held in different SPVs? I can’t think of a logical reason as to why this shouldn’t be a simple option they provide.

My Conclusions on DEGIRO

DEGIRO will be the perfect broker for some, and not for others.

If you’re looking for simplicity and low fees, then I don’t think you will find a better broker in Europe.

However, if you’re looking to day-trade or participate in complex instruments, then perhaps benchmark them against some of their competitors

There are improvements which I believe they could and should make. However, we will see if they make those changes in the coming years. They’re still a relatively new broker in the grand scheme of things.

Overall, I think DEGIRO is a great option as a broker. They’re definitely one of the best European broker options out there.

Have you signed up with DEGIRO? I’d love to hear your thoughts on them in the comments.

Degiro is a fraud. They started cleaning up their database from “passive” customers by demanding all sorts of private documents that go far beyond the usual financial audit and giving the deadlines that are very tight. Even for customers who used their platform for 5 years, while they made a lot of money on all the fees.

Furthermore when asked to transfer my portfolio to another broker account, since their demands were simply ridiculous, they asked for several hundreds of Euros for that service. And even then, they didn’t transfer it. Instead the liquidated all my positions even though some the positions were negative and I explicitly warned them to avoid this from happening.

This can happen to you as well at any moment.

They also have one of the worst customer service I ever experienced and the worst data privacy standards. I am not even sure they are within the legal boundaries.

I will start a lawsuit against them as well as write complaint to all European financial regulators.

I’ve recently changed my opinion on Degiro and will be writing an update post soon!