There’s A Benefit To Living on One Income

There are lots of benefits to being frugal while you’re only receiving one income, however, I won’t go into too much detail. I think the key overarching benefit is the reduction of stress in your life. You have a life where money is less of a worry. Considering money is one of the key causes of divorce, depression and suicide, I think this is a massive benefit.

Think about the last time you worried about money – how much different would your life be if you changed your habits so that when those nasty bills turned up, or a surprise expense cropped up, you didn’t have that horrible sense of dread in the pit of your stomach.

A lot of people get that horrible feeling when it comes to expenses and money – it doesn’t matter what your background is, or what your salary is. There are people earning 6-figure salaries who are still worrying about money and how they’re going to pay for things. It all very much depends on your lifestyle. The key to all of this is to make sure you are living below your means.

There was a study performed by the American Psychological Association which found that money was the key stressor within the American population’s lives. This found that 72% of Americans felt as though they were stressed about money within the past 12 months, and 62% reported that money had caused a significant amount of stress on a regular basis.

Being a little more frugal allows you to save a larger percentage of your income each month, and in turn, will help you sleep a little better at night.

My Top Tips For Living Frugally On One Income

I could talk all day about improving your skills in being frugal. It is exactly that…a skill

However, let me break down some little pieces of advice as a stepping stone to improving your frugality within your life. I think if you start to implement the below tips into your current routine, over time you will see a huge improvement in your finances, your stress, and your overall mental health as a result.

Live A Decluttered Life – Embrace Minimalism

This is something which I never thought I would advocate for. I’m not a natural minimalist by any means, and I’m definitely still not perfect in this regard. I think it is a slow improvement over time. There is no point in just chucking every item of excess out, and going 100% minimalism over night.

I started minimalism by removing a lot of clothes which I no longer wear. I’ve still not got this to the point where I am happy with it, but it has definitely improved things. I now wear more of the same thing on a regular basis as well, which makes decision making in the morning far simpler.

Getting rid of clothes in itself hasn’t improve my bank balance. However, the changed mentality towards clothes definitely has. Where previously I would happily buy new clothes quite regularly of varying types, styles and price tags – I now pretty much only buy clothes when I NEED them, and keep it very simple. I have become a big fan of the ASOS own brand label. I am quite tall, and they have a tall range for their clothes which has really helped me. A t-shirt can cost as little as £4, and lasts years. Compared to previously where I might spend £20+ on a t-shirt.

These are little improvements, but they really do help over time.

Use YouTube To Learn DIY

This is a change which I’ve really enjoyed.

Two years ago, my girlfriend and I moved into our first house together. It was a great house, but didn’t have much room for a table to eat. So, I set myself a challenge to build a bespoke table which would fold up into a neat size, and be easily moveable out of the way.

This is where my love for creating things and doing DIY around the house started.

A table like that which fit our requirements would have cost hundreds of pounds, while the materials for my build only cost about £60 – it saved us a fortune!

I’ve since built myself a desk for all of this working from home, amongst other things.

Everything you need to know when it comes to DIY and fixing things around the house can be found on YouTube. Obviously I don’t recommend trying to rewire the electrics of your house, but most basic things can be resolved yourself, and you can save yourself A LOT of money over time by fixing little problems yourself rather than hiring a contractor.

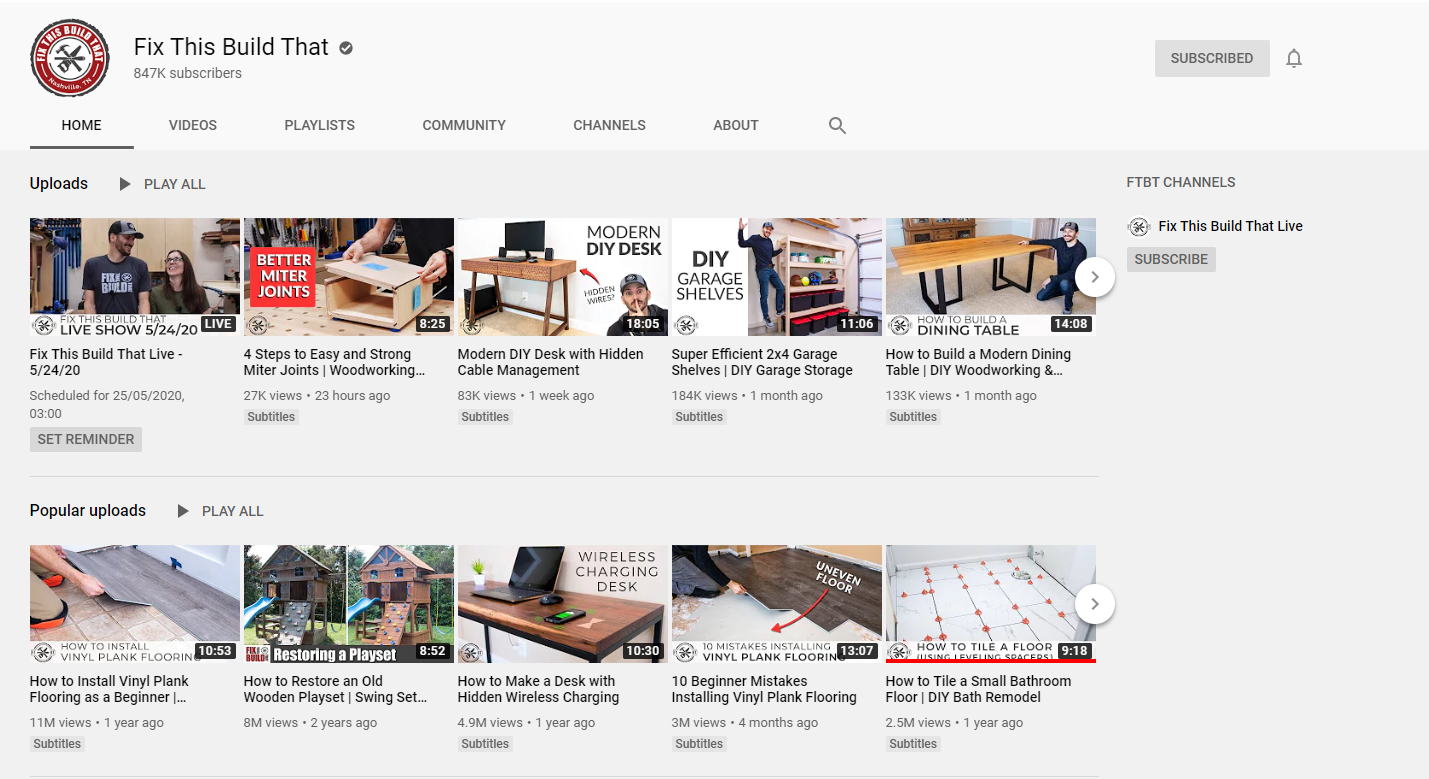

One of my favourite YouTube channels is “Fix This Build That” which has a wide array of videos on the topic of DIY skills in your household. Give him a subscribe, and tell him I sent you!

Eat Out Less/Order Less Takeaway Food

I’m very guilty of this one, especially at the start of the Coronavirus lockdown. I took advantage of too many takeaways. It is just so convenient, and no dishes to clean etc. However, when you actually add it up, if you regularly have takeaways and eat out, it can create a huge amount of spending at the end of the year.

Sit down and try and calculate how much you think you probably spend on takeaway food in a year, you might be surprised.

Sell Things You Don’t Need Anymore

eBay is a great one for this. I’m a bit of a hoarder and hate to get rid of things that I have owned for quite a while. I seem to build up some sort of sentimental bond to everything. However, selling things on eBay or a local Facebook Marketplace are great ways to reduce waste and bring in some extra money.

Set aside a weekend and spend it collecting things which you haven’t used in the past 12 months, you will likely gather a lot. Then work on creating listings and pictures for everything!

Stick To Strict Budgets

As I said at the top of this article, you need to work towards creating a budget to make sure that your single income source is utilised in the best way possible. The problem here can arise when people don’t stick to their budget. In order to be frugal, you can’t just decide you’ll be frugal. You need to set out a plan, and stick to it.

You’re not going to be perfect at keeping to your budget on your first attempt, but I promise you will get better over time.

Simplify Your Wardrobe

I mentioned this in my tip about minimalism. This is something which really helped me 1. Spend less on clothes 2. Spend less time thinking about what to wear.

In this instance, I focuse on quality over quantity. I’m now at that point where I know what brands I think I get good value from, and I pretty much just buy duplicates of that item.

For example, I buy my work shirts from TM Lewin, as in the sale I can get 5 shirts for £100, and they last for years and years. Even with my horrible ironing and washing skills.

I guess that’s another point, make sure you’re reading the label on your clothes to make sure how to wash them. Too many good (and expensive) items of clothing have been lost over the years due to accidentally shrinking them or ruining them in some way.

Buy in Bulk

Where I live we can’t benefit from shops like Costo. However, if there’s something I use regularly which comes up in a sale, I’ll definitely buy multiples of it.

The best example of this is multi-vitamins, which can be quite expensive. Boots often has a 3 for 2 deal on them, and whenever this comes up, I usually buy about 6 tubs of them, as I know I go through them quite quickly.

Other things which I will generally buy in bulk if there’s a good offer: Toilet paper, bin bags etc – Think things which you use all the time.

Reassess your Wants vs Needs

This is an important reassessment of your mindset towards spending money. Until you really think about it, you’ve likely not differentiated between what you want, and what you need. You just go “I’ll have that” and spend your money. But it is important to differentiate, and work towards reducing your impulsive spending on things that you want.

The best trick I’ve use, especially with Amazon purchases, is to create lists of things I want. If I no longer want it after 2-4 weeks, then I remove it from the list. If I still want it, assuming it is within budget, I will buy it. If I stick to this strict rule, I never waste any money on “wants” which I lose interest in quickly.

Live Within Your Means

This is a piece of advice that as a generation, I think we follow quite badly (I’m in my 20s). I’m in a generation where people are financing cars they can’t afford, living pay cheque to pay cheque. Paying monthly for holidays they can’t afford normally.

We need to reprogramme our brains to realise that while the initial dopamine rush of having something new and shiny is great…it doesn’t last. Try and understand your reasoning for spending. Perhaps even speak to a psychologist about it if you’ve really got a bad habit for spending. Many of us do it for a simple reason. It could be to make you feel better, it could be to show off, or it could be that you’re trying to keep up with your friends who earn more than you.

At the end of the day, ‘stuff’ doesn’t make you happier than being financially free. There’s no worse feeling than struggling every month because you need to come up with the money to pay for the shiny car, the flashy big screen TV, the 4 bedroom house for the two of you, the membership to the elite golf club. The list could go on.

It can be a bit of a hit to the ego, but we all should and need to live well below our pay-grade. If you do this, your chance of legitimately climbing up the financial ladder is far greater. If you could invest £1,000 a month into your investment fund, rather than on a huge mortgage payment, you’d be ultimately better off. Then, in the future, you’re likely to be able to afford that bigger house without any issues.

Reduce Your Monthly Subscriptions

We’re all guilty of it. How many subscriptions do you have? I know I have too many.

Netflix, Amazon Prime, Gym membership, the list goes on…

I’m sure you have monthly subscriptions that you don’t need, or don’t fully utilise. Pretty much the only subscriptions I really use currently are Amazon Prime deliver, and Netflix. Everything else I have eliminated. I now work out from the house, doing body weight exercises and use skipping for cardio. It saves me £50 a month in my gym membership alone.

Make some extra money online

I’ve got a whole section on this site which gives advice and reviews different systems which can help you make extra money online. Go and take a look if you’re not sure what to do. But it could be anything from selling stuff on eBay, to filling in Surveys, starting your own website design business etc. I like to spend at least an hour a day working on side projects which can benefit my monthly income on top of my career as an Accountant.

Take Action – and Live the Frugal Life!

I hope this post has made you realise that it certainly should not be a worry if you’re supporting your family with only a single income. If you implement some of my frugal tips, you’ll be able to thrive on that one income, and work towards financially benefitting you and your family.

If you have any questions at all, or would like more content like this, then please leave a comment below.

Related Articles

Accounting Automation: Should You Learn About Automation?

There is some fear in the world of Accounting that as employees we may become obsolete in the future as automation and artificial intelligence becomes more of a significant tool in the workplace. I wrote a post which you can view here, which discusses the reasons that...

US Banks for the Underserved

Banks or the banking industry have been around for centuries, with their variety of financial products and services, they have grown from an aristocratic institution to an essential commodity. Loans are often a Bank’s biggest financial product and every day millions...

Ciao! How To Leave Your Accounting Career Behind!

There's no doubt about it. Beginning your career in Accounting & Audit can build a fantastic foundation to your future, and your career potential. However, at the same time, if you don't play your cards right, it can be the poison chalice you forever regret taking...